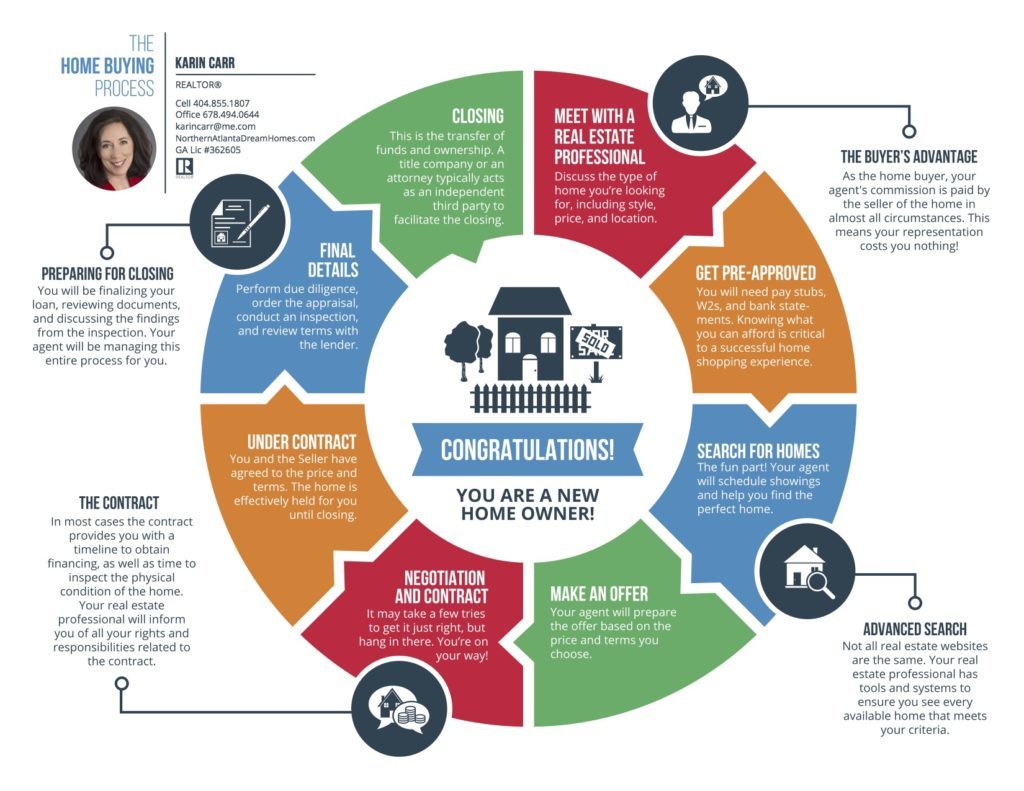

Ever wondered how the whole home buying process works? If you’re buying your first home in Canton (or Woodstock, Kennesaw, Roswell, or the surrounding areas) take a look at this infographic and I’ll break it down for you. Don’t worry, this won’t hurt a bit.

Meet with a real estate professional

The buyer’s agent doesn’t charge you, the buyer, any fees the vast majority of the time. So you don’t need to shop around based on price. Ideally you want to find someone who works in the towns you’re considering so that they’re familiar with the neighborhoods and schools if you’re buying your first home in Canton. Someone who has the time to show you homes when you’re available. And someone experienced with good negotiation skills who can fight to get your offer accepted when the competition is fierce.

Since we don’t charge you money for our assistance we will ask you to sign a Buyer/Broker Agreement. This simply says that I’m going to commit time, effort, and gas money driving around to see homes with you for as long as it takes. I’m going to advise you and negotiate on your behalf. I ask that you commit to me by getting pre-approved for a loan, making realistic offers, and tell other Realtors® that you already have an agent.

Get pre-approved

This is a biggie! A lot of agents who are desperate for business will take buyers out, show them a ton of properties, only to then find out that they can’t afford the houses they’ve been looking at. This is a huge disappointment for them, not to mention a waste of everyone’s time. It’s really important to get pre-approved before you start house hunting. Let your Realtor® refer you to a lender if you don’t know anyone who can help you. You want a lender who has lots of options so that you can choose the best loan program with the best terms. Once they tell you how much you are approved to spend, THEN go out house hunting. And you don’t have to spend as much as you get approved for. Just because you get approved for a $400,000 loan doesn’t mean you have to buy a house that costs that much. Figure out what monthly payment you’d be comfortable with and shop for homes in that price range.

Search for homes

You can look at any home that’s for sale on the Multiple Listing Service (MLS), not just your own agent’s company listings. So if you’re buying your first home in Canton don’t choose an agent from Lawrenceville. Not that they can’t help you, but are they going to want to jump in the car and drive 90 minutes to show you two houses on a Friday afternoon? Probably not. We can even show you For Sale By Owners most of the time. Just do us a favor please. Don’t wander into an open house or a model home in a new subdivision without letting the agents there know that you have your own representation. We Realtors® do not earn a paycheck until closing day, and it really hurts when a client we’ve been working with for months writes an offer with another agent. This prevents you from being pursued by other agents who think you need assistance, and ensures that we will be able to represent you in your purchase.

Make an offer

So now you’ve found a great home and you want it. Time to write an offer. How do you know what to offer? Your agent will help you figure out what the home’s market value is and strategize with you on the price to offer. I always recommend to my buyers to offer less than you’re willing to pay so you have some room to negotiate, unless you desperately want the house and are in a position to try to outbid other buyers. If you are asking the seller to pay your closing costs and asking for other seller concessions (things for them to pay for like any inspections or warranties) then you will want to be strong on purchase price. A low offer with a ton of seller concessions won’t get much attention, especially if there are multiple offers on the table.

Negotiation and contract

Hopefully the first offer worked, but maybe it took a few homes to get you there. Or maybe a few counter offers back and forth. If you make an offer and the seller wants to change even one item, such as the closing date, they will make a counter offer. You may have to counter back and forth until all terms are agreed upon. It works best if everyone feels like the got what they needed in the end and no one feels like the other party took advantage of them.

This is important later. Perhaps the seller feels like you took them to the cleaners with all your demands. If you do a home inspection and ask them to make some repairs, how likely do you think they will be to agree? If you ask for them to give up something, try conceding to their wishes on something else so that everyone feels like the deal was fair.

Under contract

Yay, you did it! You are buying your first home in Canton! Now what? First you’ll put down a deposit, usually a couple thousand dollars, as a good faith deposit called earnest money. This will get deposited right away and will be applied toward your down payment. Now you have the house locked down and no one else can steal it away unless you don’t perform according to the terms of your contract.

The lender will order an appraisal, which means they hire someone to verify that the price you’ve offered is an accurate market value. They won’t lend you $200,000 for the house if it’s only worth $195,000.

Final details

You’ll have several days for “due diligence”, which is where you check out the house and neighborhood to your heart’s content. You’ll probably want to do some inspections. A whole home inspection is typical, maybe a termite inspection, or a roof inspection or property survey. You can go over to the house at 6:30 am and practice driving to work to see what the commute is like. In Georgia, during due diligence you can cancel for any reason at all and get your earnest money back. As long as you cancel during due diligence you will be entitled to get your earnest money back.

If the house has major problems that make you not want the house anymore you can cancel. Or you may choose to ask the seller to either reduce the sales price or do the repairs prior to the closing date. If you gave them what they wanted at the time of the offer the chance of getting them to make repairs is higher than if you made a lot of demands up front. Your agent will help you decide how to write up a request for any repairs.

Now the appraisal comes back and hopefully it appraised for your sales price or higher. If it comes back low, there are a few ways this can play out:

- You ask the seller to drop the price and they agree

- You ask the seller to drop the price and they say no. You can either cancel or pay the difference in cash at closing. (Sales price is $200,000, it appraises for $195,000, so you come to the closing table with an extra $5000.)

- You ask the seller to drop the price and you both agree to split the difference at $2500 each.

- You ask the seller to drop the price and they say no deal, so you cancel and get your deposit back.

This happens a lot in an appreciating market so have a game plan for what you’ll do if this happens.

On the loan side, the lender you choose will ask for all kinds of crazy things. This will seriously make you want to pull out your hair – I just bought a house last year so this is still fresh in my mind. They might say, “I see you were 3 days late on your credit card bill last September. Can you write us a letter explaining why?” They are trying to avoid having a foreclosure crisis like we had in the late 2000’s. The stricter they are with their requirements now, the less likely the chance that you’ll stop paying the mortgage in a few years. Just grit your teeth, smile, and say, “Sure thing!” And send it to them asap. It’s the difference between buying your house and living in your tiny apartment for another year. Or two.

Closing

You’ve gotten the green light from your lender, the house is in great shape, the appraisal came in at value, and you’re ready to close! Once the lender has signed off on your loan they will send you a CD (closing disclosure) telling you your monthly payment, your interest rate, and what this house is going to cost you if you keep it for 30 years. Don’t look at this number. It will make you cry. Just kidding! Kind of. The interest over 30 years is pretty steep but people move every 5-7 years on average so hopefully you’ll either move long before 30 years or pay it offer sooner.

Now you’re ready to close! This is where you, the sellers, and the agents all meet at the attorney’s office. You’ll bring a check for your down payment (minus the earnest money you’ve already paid) and any closing costs. You can also wire the money if you prefer not to bring a cashier’s check. Everyone signs papers transferring ownership of the house, and you will sign page after page after page promising to pay back the loan. Be sure to bring a photo ID and sign your name the way it appears on the contract.

At the end of this signing you get the keys. Congratulations! You’re a homeowner!

Is it stressful? Yes. Is it exciting? Yes! Is it beyond wonderful to call this home your own and be able to paint it, remodel it, decorate it, and do whatever you want to it? YES!!!! And it is smart to sell it later down the road and make a cool $10,000 or more (much more!) when you do rather than renting and not making a dime when you move out? Heck yeah!

Need more advice on buying your first home? Check out these other blog posts:

Tips to save for a down payment

When buying your first home make sure it has these 4 things

How to prevent buyer’s remorse

Buying a home as a newly married couple

About the Author: The above article was written and provided by Karin Carr, an authority on the Canton/Woodstock/Kennesaw area, as well as a leader in the field of Real Estate sales, marketing, and smart home technology. Karin can be reached via email at [email protected] or by phone at 404-855-1807. Karin has helped many people buy and sell Cherokee Country and Cobb County area homes for years.

Thinking of selling your home? I have a real passion for buying and selling Real Estate, as well as marketing & smart home technology. I’d love to share my expertise!

I help people buy and sell real estate in the following north Georgia cities: Acworth, Ball Ground, Canton, Kennesaw, Woodstock, White, Roswell, Milton, Alpharetta, Dallas, Powder Springs, and the surrounding areas.